I. Digital Assets: The Modern Frontier of Investing

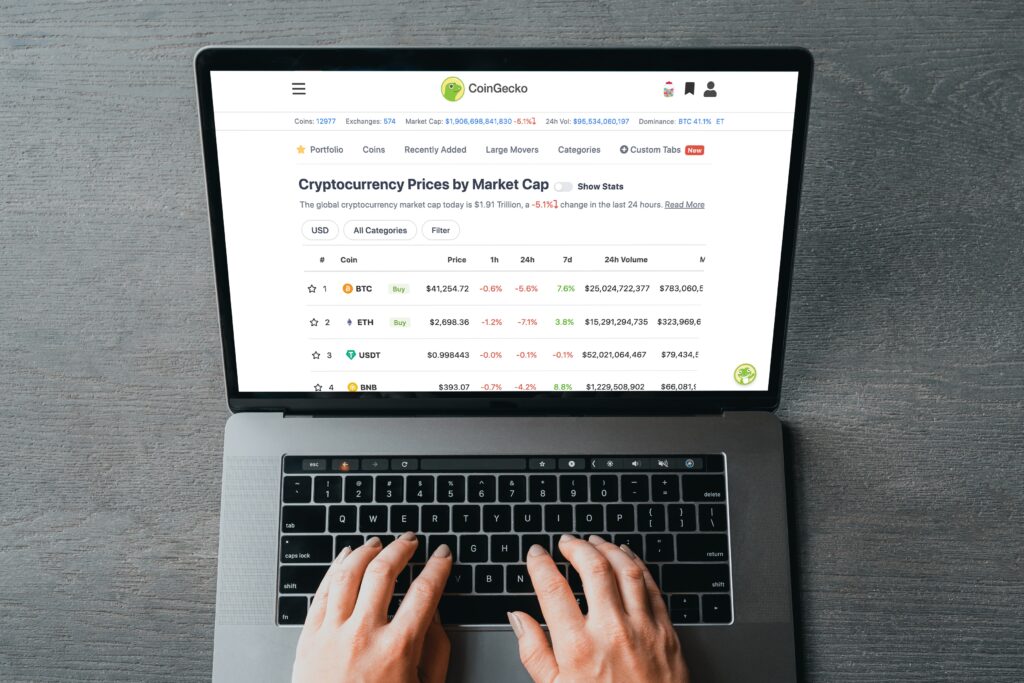

Digital assets have taken the investment world by storm, revolutionizing how we store and trade value. When we talk about digital assets, we are talking about specific cryptocurrencies that have real utility and will be the future of our world. There are many cryptocurrencies that will not succeed; therefore, those are not true digital assets.

Investing in digital assets holds great promise for those seeking high returns and rapid growth. The decentralized nature of cryptocurrencies means that they operate independently of any central authority or government, and are available for trading around the clock. This accessibility, combined with the constant innovation and technological advancements in the field, has made digital assets a great option for forward-thinking investors.

Investing in digital assets is a unique opportunity. It is the beginning of a new technology which means there is going to be a lot of wealth created. For example, these companies arising in the blockchain industry will be like Amazon in the early 2000s. A new technology that can 200x and even more. This could be a huge opportunity to invest in your future.

However, it’s important to approach digital asset investment with caution. The markets can be highly volatile and prices can experience significant fluctuations. Economist Impact has a great article on how to stabilize in the midst of volatility. Keeping your digital assets secure is crucial, as cyber-attacks and the risk of hacking are ongoing concerns. Additionally, the regulatory landscape surrounding cryptocurrencies is still evolving, making it essential to conduct thorough research and due diligence before entering this new frontier.

Benefits of Investing In Digital Assets

Benefits of Investing In Digital Assets

- Potential for High Returns

- Liquidity and Accessibility

- Diversification to Counter Traditional Market Volatility

***Learn how to avoid these and invest in your future through a simplified step by step program and weekly Next Move

Risks and Challenges- Regulatory Uncertainty and Security Concerns

- Volatility and Market Manipulation

- Technological and Operational Difficulty

***Overcome these challenges by education yourself with the CryptoStart Program.

Strategies for Investing in Digital Assets- Learn to dollar cost average

- Follow a technical analysists weekly

- Learn to stay calm and hold through volitility

***Discuss various investment strategies, including long-term holding, dollar-cost averaging, and diversified portfolios with a digital asset consultant. Click here to start your crypto journey and learn these steps and more with a simplified step by step process. Invest in your future by first investing in yourself.

II. Gold and Silver: Time-Tested Assets for Preserving Wealth

Investing in gold and silver offers several advantages, the foremost being diversification and a hedge against inflation. During times of economic uncertainty, these precious metals have historically retained their value or even appreciated. Their stability and reduced volatility compared to digital assets and real estate make them an attractive addition to any investment portfolio.

When investing in gold and silver, it’s crucial to consider factors such as authenticity and purity. Purchasing from reputable sources and verifying the authenticity of the metals is vital. Additionally, determining the appropriate allocation based on your risk tolerance is essential for a well-balanced investment strategy. Lastly, consider the options for storing physical holdings, ensuring their safety and liquidity whenever required. Start understanding gold and silver by checking out the pros and cons of each. Invest in your future with gold and silver.

Benefits of Investing in Gold and Silver

- Hedge Against Inflation

- Safe-Haven Assets during Economic Uncertainty

- Tangible and Long-lasting Value

Risks and Considerations

- Volatility and Market Manipulation

- Storage and Security Concerns

- Market Liquidity

Strategies for Investing in Gold and Silver

- Learn to dollar cost average over a long-term period

- Study trends within inflation and deflation

- Consider starting with silver

***Learn about how accumulate on the side of other investments via personal consulting or follow the Next Move to learn more!

III. Real Estate: Building Wealth Brick by Brick

Real estate has long been regarded as a pillar of wealth creation, offering both income generation and potential appreciation in value. Investing in real estate provides the opportunity to accumulate equity over time, build a substantial rental income, and protect against economic downturns.

There is now going to be way more opportunity to build wealth with real estate due to emerging technology within the blockchain arena. Through decentralized finance and tokenization, real estate will be accessible to a larger majority of people that have once not been able to invest. The best way to position yourself to take advantage of the tokenization of real estate is to learn more about digital assets and blockchain technology. Start learning with this simplified step by step guide that can help you invest in your future.

Benefits of Investing in Real Estate

- Appreciation and Potential for Rental Income

- Portfolio Diversification and Inflation Hedge

- Tax Advantages and Leverage Opportunities

Risks and Challenges

- Market Volatility and Liquidity Constraints

- Management and Operational Responsibilities

- Regulatory and Legal Considerations

Strategies for Investing in Real Estate

- Talk to experienced investors

- Learn about where the economy is heading in the future

- Study history during inflation and deflation

***Follow The Next Move in order to stay updated with economic events and the real estate market.

Invest In Your Future Today

Investing in your future through a well-rounded portfolio of digital assets, gold, silver, and real estate is a powerful strategy to build long-term wealth and achieve financial freedom. By diversifying across different asset classes, you minimize risk and maximize potential returns. However, it’s important to tread carefully in this ever-changing investment landscape.

Thorough research, consultation with professionals, and understanding the unique characteristics, advantages, and risks of each asset class will set you up for success. Start today by assessing your financial goals, risk tolerance, time horizon, and most importantly investing in yourself. Arm yourself with knowledge, take a proactive approach, and embark on the golden path to financial freedom by investing in your future.